change in working capital formula fcff

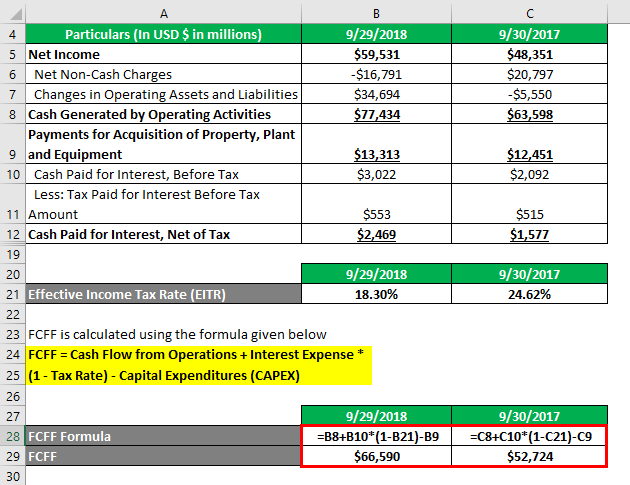

FCFE Formula FCFF Interest x 1-tax Net Borrowings. Apple Incs FCFF has increased from 2017 to 2018.

Free Cash Flow Meaning Examples What Is Fcf In Valuation

EBITDA Earnings before interest taxes depreciation and amortization Real World Example of Free Cash Flow.

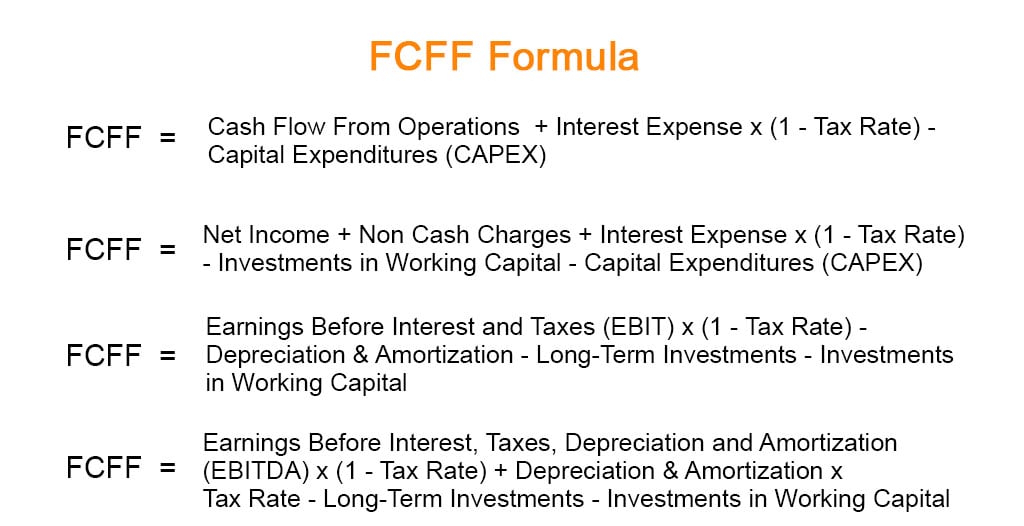

. FCF EBIT1-Tax Rate Depreciation and Amortization Capital Expenditures Increases in Net Working Capital NWC If you have. 22 Apr 2017 at 737 am. NI net income NCC noncash charges Int inrerest expense.

It means that the cash flow available with Apple Incs suppliers of capital after all operating expenses made and meeting investments in. Working capital increases. FCFF Calculator Click Here or Scroll Down The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before.

FCFF is the cash flow available to a firms capital providers after deducting operating expenses working capital expenses and fixed capital investments. For most companies you analyze by using the change in working capital in this way. Changes in Working Capital.

FCFF is calculated from net income as. The more free cash flow a company has the. Change in working capital investment current assets cash and cash equivalents.

Moving to cash flow statement - net income is up 60 but change in working capital is a 100 outflow increase in AR resulting in. Owner Earnings 8903 14577 5129 13312 2223 13084. This definition of working capital excludes cash and cash equivalents and short-term debt notes payable and the current portion of long-term debt payable.

FCFF NI NCC im X l - tax rate - FCInv - WCInv where. Do not include non-operating. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth.

Below is the calculation for working capital. Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures. Changes in working capital -2223.

The reason why we subtract out the change in working capital is the fact that we would either come up with a decrease in cash flows if the change is positive or an increase in. Change in Net Working Capital NWC Prior Period NWC Current Period NWC As a sanity check you should confirm that if the NWC is growing year-over-year the change should be. From the Current Assets Current Assets Current.

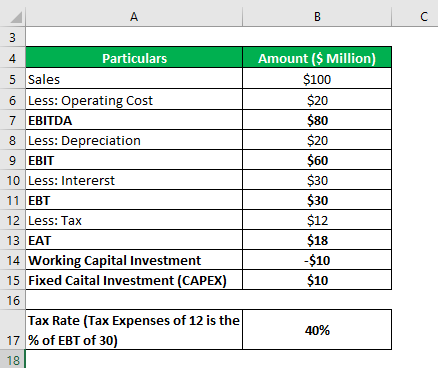

Heres the formula for free cash flows Ill be referring to. From the 12m in NOPAT we add back the 5m in DA and then finish the calculation by subtracting the 5m in CapEx and 2m in the change in NWC for an FCFF of 10m. May 20 2011 - 304pm.

Free cash flow decreases. -2572 Change in Net Working. Under ordinary operating conditions many if not most companies have positive working capital current assets exceed.

FCFF EBITDA 1 TR D TR LI FCFF IWC where. The formula you have is the FCF to the firm. When Im interviewing and breaking down the FCFF formula I say Changes in NWC except for cash.

FCFF Net Income Non Cash Charges Interest Expense 1 Tax Rate Investments in Working Capital Capital Expenditures CAPEX FCFF 18 20 18 10.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Efinancemanagement

Fcff Formula Examples Of Fcff With Excel Template

Changes In Net Working Capital All You Need To Know

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Fcf Formula Formula For Free Cash Flow Examples And Guide

Fcff Formula Examples Of Fcff With Excel Template

Change In Working Capital Video Tutorial W Excel Download

Fcff Formula Examples Of Fcff With Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow To Firm Fcff Formulas Definition Example

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)